Bitcoin has taken the world by storm, transforming from a niche digital currency to a household name. Whether you’re an avid investor or just curious about the buzz, understanding Bitcoin https://finanzasdomesticas.com/el-precio-del-bitcoin/ landscape. From its inception as an experimental project to becoming a significant player in global finance, Bitcoin’s journey is nothing short of fascinating.

But what influences its price? Why does it fluctuate so dramatically? As more people get interested in this cryptocurrency phenomenon, knowing how to navigate the market becomes essential for anyone considering investing. This guide will delve into everything you need to know about Bitcoin’s price—its history, factors that affect it, and tips on smart investment strategies. Get ready to unlock insights that could change your perspective on not just Bitcoin but the entire realm of digital currencies!

Understanding the Basics of Bitcoin

Bitcoin is a decentralized digital currency, created in 2009 by an anonymous figure known as Satoshi Nakamoto. Unlike traditional currencies issued by governments, Bitcoin operates on a technology called blockchain. This ensures transparency and security through a distributed ledger that records all transactions.

Users can buy, sell, or trade Bitcoin without the need for intermediaries like banks. Transactions are fast and often come with lower fees compared to conventional banking methods.

One of the defining features of Bitcoin is its limited supply—only 21 million coins will ever exist. This scarcity contributes to its value over time as demand increases.

Investing in Bitcoin requires understanding wallets, which store your coins securely. Whether you’re looking at it as an asset or merely experimenting with digital finance, grasping these basics sets the foundation for deeper exploration into this revolutionary currency.

Factors Affecting the Price of Bitcoin

The price of Bitcoin is influenced by various factors that can shift rapidly. Market demand plays a crucial role. When more people want to buy Bitcoin, the price tends to rise.

Regulatory changes also impact its value significantly. News about government policies or restrictions can create immediate reactions in the market.

Technological advancements deserve attention too. Improvements in blockchain technology or security measures can enhance confidence among investors, driving up prices.

Market sentiment cannot be overlooked either. Social media trends and news coverage often sway public perception, leading to sudden spikes or drops in value.

Competition from other cryptocurrencies affects Bitcoin’s standing as well. Newer coins with attractive features may draw investors away, influencing Bitcoin’s market share and price dynamics.

All these elements create a complex web that shapes Bitcoin’s ever-changing landscape.

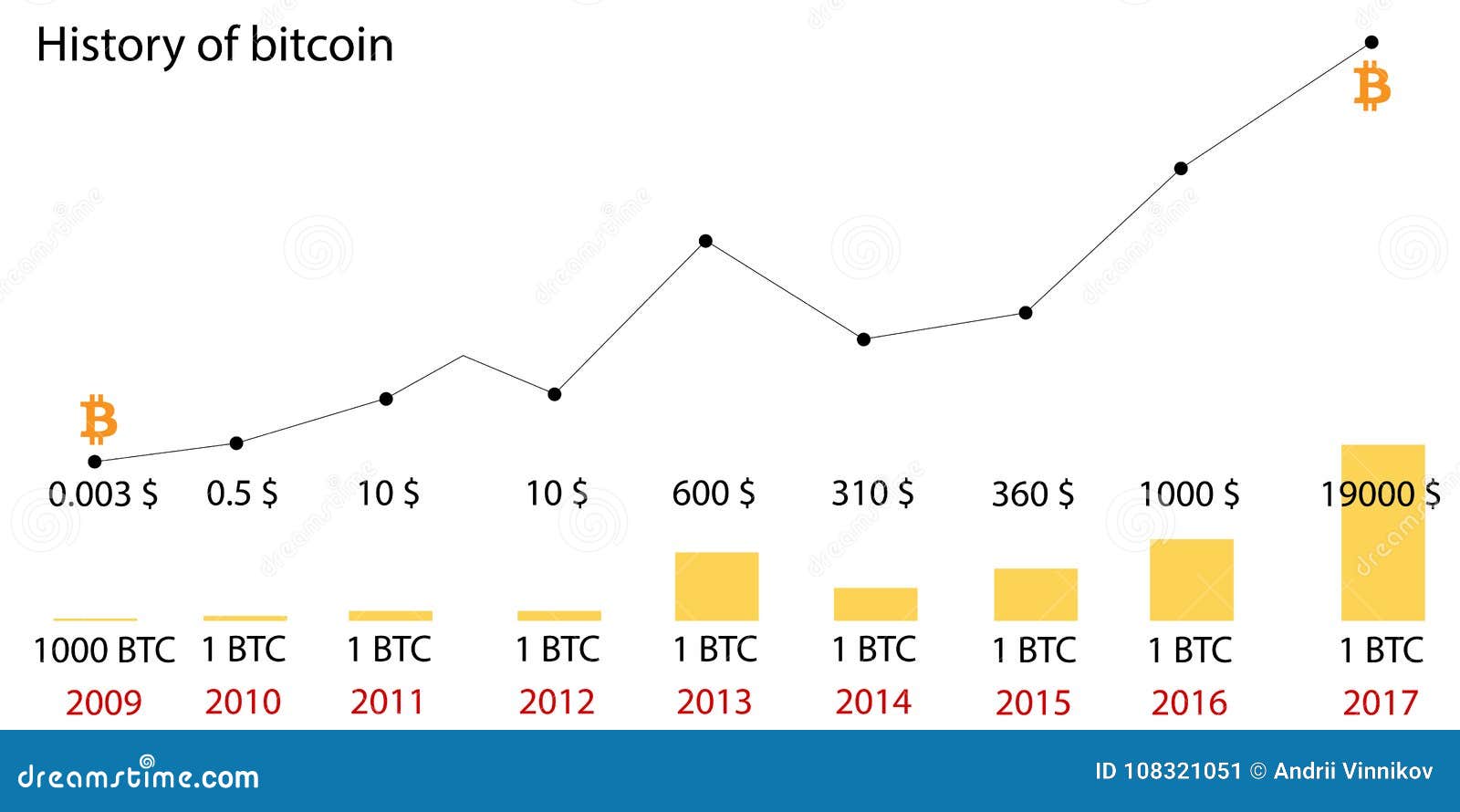

The History of Bitcoin’s Price Fluctuations

Bitcoin’s journey began in 2009 with a mere value of zero. The first recorded transaction took place in 2010 when someone famously paid 10,000 BTC for two pizzas. That moment marked the start of its price discovery.

In late 2013, Bitcoin surged to over $1,000 for the first time, capturing global attention. However, this spike was followed by significant drops, leading many to question its viability as an investment.

The years that followed saw wild fluctuations. In early 2017, Bitcoin reached nearly $20,000 before crashing down to around $3,200 by December of the same year.

Since then, it has seen tremendous highs and lows driven by market sentiment and regulatory news. Each peak often brings excitement while each valley fosters skepticism about its future stability and adoption as a mainstream currency.

Predictions for the Future of Bitcoin’s Price

As we look ahead, Bitcoin’s price predictions are a hot topic among investors and analysts alike. The cryptocurrency market is notoriously volatile, making accurate forecasting challenging.

Many experts believe that institutional adoption will play a significant role in driving prices higher. As more businesses recognize Bitcoin as a legitimate asset class, demand may surge.

Technological advancements also influence future value. Upgrades to the blockchain could enhance security and speed, attracting new users and potentially pushing prices upward.

However, regulatory hurdles remain a concern. Governments worldwide are still figuring out how to handle cryptocurrencies. Any unfavorable regulation could lead to sharp declines in price.

Market sentiment can shift rapidly based on news cycles or broader economic conditions. Keeping an eye on global events is crucial for understanding potential price movements moving forward.

How to Invest in Bitcoin Wisely

Investing in Bitcoin requires a strategic approach. Start by educating yourself about this digital currency. Understand its technology and market dynamics.

Diversification is key. Don’t put all your funds into Bitcoin alone. Explore other cryptocurrencies to spread risk effectively.

Set a budget for your investment, and stick to it. Only invest what you can afford to lose without affecting your financial stability.

Consider using dollar-cost averaging, where you buy small amounts of Bitcoin regularly over time. This method reduces the impact of volatility on your overall investment.

Stay updated with market trends and news but avoid making impulsive decisions based on short-term fluctuations.

Utilize reputable exchanges for transactions, ensuring security measures are in place to protect your investments from hacks or thefts.

Think long-term rather than seeking quick profits. A patient strategy often pays off more substantially in the volatile crypto landscape.

Risks and Benefits of Investing in Bitcoin

Investing in Bitcoin offers a unique blend of risks and rewards. On one hand, the potential for high returns can be enticing. Many early adopters have seen their investments grow exponentially.

However, volatility is a significant concern. The price of Bitcoin can swing dramatically in short periods, leading to substantial losses for investors who are not prepared.

Security is another factor to consider. While blockchain technology is generally secure, exchanges can be vulnerable to hacks. Investors must stay vigilant about protecting their assets.

Regulatory changes also pose risks; as governments adapt to cryptocurrencies, new laws may impact how Bitcoin operates and its value.

On the flip side, investing in Bitcoin diversifies an investment portfolio. Its decentralized nature appeals to those looking for alternatives outside traditional finance systems. This aspect alone draws many into the crypto space with excitement and anticipation for future growth opportunities.

Conclusion

Investing in Bitcoin can be an exciting venture, but it comes with its own set of challenges and rewards. As we’ve explored, understanding the basics of Bitcoin is crucial for anyone looking to engage with this digital currency. The factors influencing its price are varied and complex, from market demand to geopolitical events.

The historical fluctuations remind us that volatility is a hallmark of the cryptocurrency landscape. While predictions offer insights into potential future movements, they remain speculative at best.

Approaching investment in Bitcoin requires careful consideration and strategy. It’s essential to weigh https://finanzasdomesticas.com/el-precio-del-bitcoin/ before diving in. Knowledge is your best ally here; staying informed about trends will help you make more educated decisions.

Whether you’re considering investing or simply curious about how Bitcoin behaves as an asset class, it’s vital to stay vigilant and adaptable in this ever-evolving financial world.